March 24, 2017

On March 22, two State Senate committees heard testimony on Illinois’ fiscal crisis. The not surprising message of the nearly three-hour hearing: the State’s budget problems have built up over many years, driven largely by rising pension costs, and will not be easy to fix.

Thomas Walstrum, an economist at the Federal Reserve Bank of Chicago, testified about his research on the history of Illinois’ fiscal performance, which compares Illinois’ spending and revenues with that of other states. To account for differences in the division of government responsibilities across states, Mr. Walstrum looked at activities at both the state and local levels. He examined spending and revenue as a share of gross state product (GSP), also known as gross domestic product by state, to account for differences in the size of state economies.

The Fed economist found that Illinois was a relatively low-spending, low-revenue state in the late 1980s. In fiscal year 1988, spending represented about 16% of GSP and revenue about 15.5%. That compares with an average for all states of 18% for spending and about 19% for revenue.

Since the late 1980s, Illinois’ spending as a share of GSP has come to mirror the national average, according to the research. Meanwhile, the gap between Illinois’ revenues and those of the average state has only narrowed slightly.

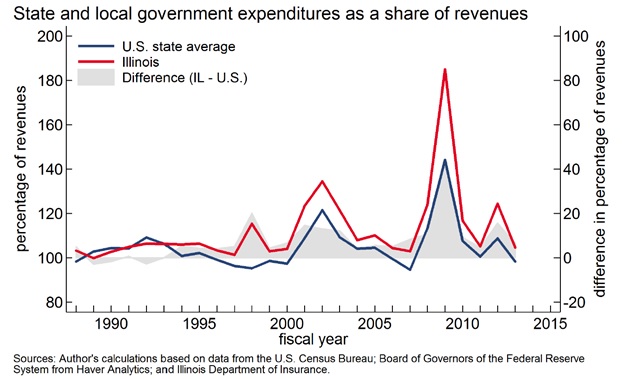

As a result, by the mid-1990s, Illinois was spending a greater share of its revenues than the average state. The following chart, included in Mr. Walstrum’s presentation to the Senate Appropriations I and II Committees, shows expenditures as a percentage of revenues for Illinois and the U.S. state average. The shaded area represents the gap between Illinois and the state average.

The chart shows that Illinois has spent more than it has collected in revenues since the late 1980s. While other states have also overspent on average, Illinois’ overspending has exceeded that of other states.

From FY1994 through FY2010, Illinois’ spending averaged about 116% of its revenues, compared with a state average of approximately 106%. The State of Illinois temporarily increased income tax rates in January 2011 to 5.0% from 3.0% for individuals and 7.0% from 4.8% for corporations. These rates were rolled back to 3.75% for individuals and 5.25% for corporations in January 2015.

Why does Illinois spend more of its revenue than the average state? According to the research, about three-quarters of the difference stems from Illinois’ massive pension obligations. Mr. Walstrum treats both yearly payments to retirees and annual changes in pension liabilities as expenditures. Unlike State and local budgets, this method explicitly accounts for increases in pension debt.

Similarly, changes in pension assets are treated as revenues. The spikes in the chart in the early 2000s and in 2009 are related to stock market downturns, which depressed pension assets in Illinois and other states and decreased revenues.

In response to questions from lawmakers, Mr. Walstrum said economic growth alone is unlikely to fix Illinois’ budget problems. He declined to take sides on the politically charged issue of whether the State has a spending or revenue problem, but said any solutions would require changes in both areas.

Laurence Msall, President of the Civic Federation, also testified at the hearing. Mr. Msall reviewed the recommendations in the Federation’s State of Illinois FY2018 Budget Roadmap, which was issued on February 10.

As previously discussed on this blog, the report proposes stabilizing the State’s finances through spending limits, revenue increases and borrowing to pay down the multi-billion dollar backlog of unpaid bills. Mr. Msall emphasized that the Federation only supports borrowing in conjunction with a balanced budget and a credible plan to restore confidence in the State’s finances.

Senators questioned Mr. Msall about the economic impact of the proposed tax increases and expressed concern that additional taxes would accelerate the exodus of individuals and businesses from Illinois. In addition to the spending controls, the Federation’s proposal includes an increase to 5.25% in the individual tax rate and 7.0% in the corporate tax rate; an expansion of the income tax base to retirement income; and an expansion of the sales tax base to consumer services. The plan also includes a reduction in the overall State sales tax rate.

Mr. Msall said the major concern for businesses is uncertainty related to the State’s 21-month budget impasse. He commended Senate leaders for attempting to break the deadlock and urged them to pass legislation on to the House.